Understanding your Property Tax Statement

Understanding your Property Tax Bill

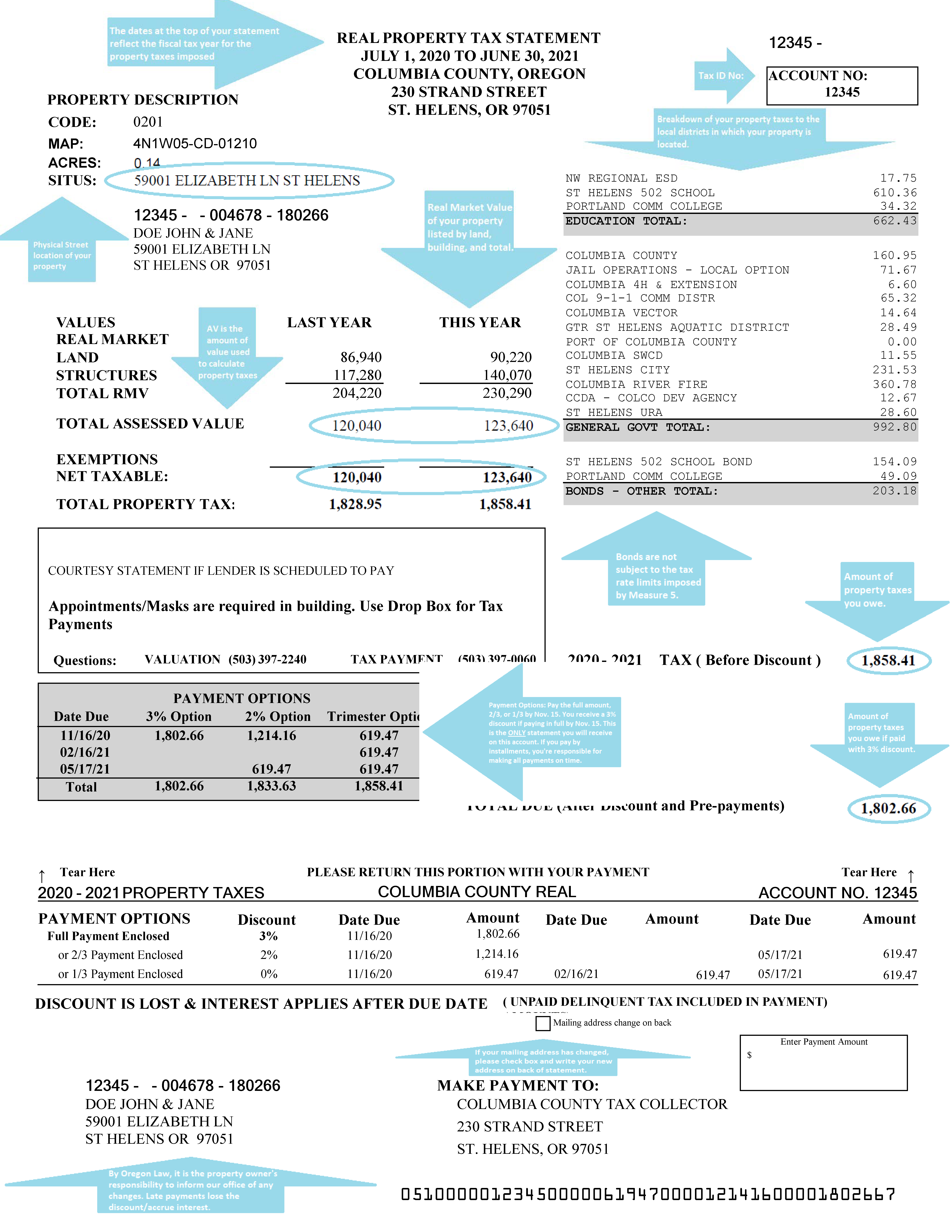

Property tax statements for 2020-2021 will be mailed out the week of October 19th.

.png)

Be sure to mail your payment early enough to be postmarked on or before November 15. According to Oregon law, if the postmark is after the payment due date, discounts are not allowed and interest will accrue on the past due portion. If the due date falls on a weekend or a legal holiday, the due date is extended through the next business day.

Please return the lower portion of your tax statement(s) with your payment and use the enclosed envelope with the appropriate postage. Write your account number(s) on the front of your check to ensure proper credit. Your cancelled check is your receipt. The upper portion of the tax statement should be kept for your records.

- Payment for property taxes must be credited to the earliest year for which the taxes are due on the property for which the payment is being made.

- The due date for property tax payments is November 15.

- Please mail early to ensure you receive the discount and avoid interest.

Understanding your Property Tax Statement

The property tax statement you receive in the fall is your value notice and property tax bill for the current tax year, July 1 through June 30. The tax you pay is the result of the districts' tax rates applied to your property's assessed value. In addition, the bill may include other taxes, fees, charges or assessments depending on the districts provided services to your property. These other taxes, fees, charges or assessments may not be based on the value of your property.

Click Here to See Full Size Image

The tax statement is designed to provide the maximum amount of information about your property.

- Current tax year

- Your name and mailing address

- Return mailing address and phone number for Columbia County Tax Collection

- A brief legal description, if entered in the computer

- Tax code area

- Account ID number

- Assessor's map number

- Acres, if entered in the computer

- Type of property (real, personal, or manufactured structure)

- Tax amounts from last year

- Values from last year and the current year

- Mortgage company lender code if applicable

- Tax for the current year by district name and totals for education, government, and other categories

- Total tax amount due

- Payment amounts with applicable discounts

- Due dates

- Appeal rights and payment schedule on the reverse side

- Change of address

RMV: Real Market Value

Real market value is the assessor's estimate of what your property would sell for as of January 1.

Your tax statement shows:

RMV LAND: Real Market Value for land

RMV IMPR: Real Market Value for improvements, such as buildings.

RMV TOTAL: Real Market Value - Total of land and improvements

SAV: Specially Assessed Value

Specially assessed value refers to land that is not valued at its real market value, but rather on a special use, such as farm or forestland.

The real market value or the specially assessed value is used for the education and general government rate limits under Measure 5.

MAV: Maximum Assessed Value

Maximum assessed value was established in 1997 by the Oregon Legislature through Senate Bill 1215 (also known as Ballot Measure 50) for all properties that existed in 1997-98. The MAV is allowed to increase each year by no more than 3 percent. There are exceptions to the 3 percent limit, such as new construction and subdividing or partitioning of property.